JinkoSolar Lists in Germany, Boosting Solar Investment

Advertisements

On October 20th, JinkoSolar, a leading player in the vertical integration of photovoltaic (PV) solutions, announced its intention to list on the Frankfurt Stock Exchange by issuing Global Depository Receipts (GDRs). If approved, this will position JinkoSolar as the first company from China’s Sci-Tech Innovation Board to enter the German capital market through GDRs. Such a move is expected to catalyze the bilateral cooperation between China and Europe in sustainable finance and carbon neutrality initiatives, potentially elevating their collaborative efforts to new heights.

In recent days, another domestic giant, Sungrow Power Supply, which specializes in inverters and energy storage, revealed a similar plan to issue GDRs and pursue a listing in Germany. This coordinated announcement from these industry leaders underscores the outcomes of the high-level financial dialogue held last October, where both parties committed to increasing support for enterprises to issue GDRs and enhancing the connectivity between Chinese and German capital markets.

According to the release, JinkoSolar’s pricing for the GDR issuance will be set at no less than 90% of the average closing price of its A-shares over the twenty trading days preceding the pricing date. The total amount to be raised will not exceed 4.5 billion CNY or the equivalent in foreign currency. The funds will primarily be allocated to a 1GW high-efficiency solar component project in the U.S. and the expansion of its integrated manufacturing base in Shanxi with a capacity of 14GW. JinkoSolar emphasized that this GDR issuance will bolster its leadership in N-type solar cells, enhance profitability, and enable more flexibility in responding to international trade barriers, while also optimizing its capital structure and enhancing its risk resistance capabilities.

Global Expansion and Differentiation

Photovoltaics have become a significant export good for China, and JinkoSolar exemplifies the push for globalization from top-tier domestic solar companies. According to the mid-year report for 2024, approximately 65% of JinkoSolar’s sales come from overseas markets, with international revenue exceeding 70%, ranking the company among the leading solar producers worldwide. Notably, the company also possesses the industry's largest overseas integrated production capacity and employs thousands of workers abroad, successfully aligning with international standards in research and development, branding, and Environmental, Social, and Governance (ESG) criteria.

JinkoSolar's pursuit of an overseas listing reflects its enhanced capabilities in global operations. The implementation of the fundraising projects will further elevate its localized manufacturing capabilities in key global markets, promoting local production, consumption, and supply.

Once the U.S. 1GW high-efficiency component project is completed, JinkoSolar’s total component capacity in the U.S. will reach 3GW. Amid a surge in demand for clean energy driven by advancements in artificial intelligence, the company is poised to stabilize its shipments in high-value markets while adeptly navigating the uncertainties surrounding trade policies, which is expected to yield better profit margins.

The Shanxi Phase II project, with its 14GW integrated potential, was publicly announced in May of last year. This ambitious endeavor consolidates wafer production, cell cutting, battery assembly, and modules at a single facility, effectively reducing labor and logistics costs. Moreover, the deep integration of intelligent technologies will allow for efficient tracking of carbon footprints and supply chains, thus catering more effectively to the diverse needs of overseas clients focused on green manufacturing and supply chain compliance.

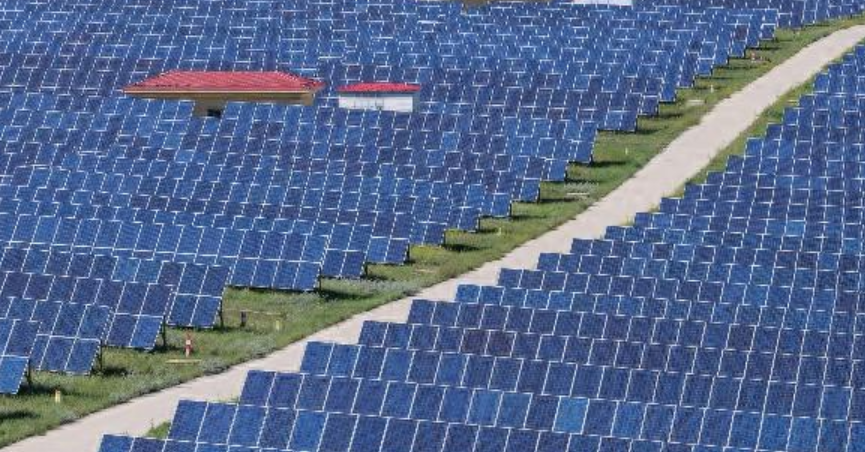

Germany, the chosen location for this listing, is Europe’s largest single photovoltaic market. In April 2024, JinkoSolar delivered over 1.1 million units of its new N-type components to the Witznitz Solar Park, one of the largest solar power stations in Germany. The Frankfurt Stock Exchange stands as the second largest stock exchange in Europe. A successful GDR offering would significantly enhance JinkoSolar’s visibility in the German and broader European markets, thereby fostering positive developments in its overseas operations and financing channels.

Attracting International Long-term Investors

The photovoltaic industry, after enduring two years of considerable adjustments, is nearing historic lows in valuation levels. A recent report from Goldman Sachs signaled that the current downturn in the solar sector is nearing its end, predicting the possibility of entering a cyclical bottom by 2025, with sustainability in demand poised to enhance capacity utilization rates thereafter.

On October 14th, the China Photovoltaic Industry Association convened a roundtable in Shanghai discussing the industry's "anti-involution" measures. Attendees, comprising industry leaders, fostered exchange on enhancing industry self-disciplinary practices, preventing cutthroat competition, reinforcing market selection, and improving pathways for the exit of outdated production capacity. This meeting has ignited optimism for a swift recovery and a return to growth in the industry.

In the long term, with a growing global consensus on the need for sustainable energy and low-carbon economies, the potential for solar power—recognized as the cleanest, most economical, and most intelligent form of energy—remains untapped. Bloomberg New Energy Finance projects that global added capacity for solar installations will reach 592GW in 2024, with general sentiment anticipating this figure will surpass 1000GW around 2030.

Through the recovery of the industry, leading companies that possess advantages in technology, market reach, and scale often attract interest from long-term international investors. JinkoSolar and Sungrow Power Supply, as the foremost players in the solar components and inverter segments, are at the forefront of the rapid GDR issuance expansion since 2022 and are among the first to embark on overseas financing following the new GDR regulations introduced in 2023. The timing of their overseas financing announcements—made within the same week during discussions on industry "de-involution"—may signal the initiation of a new cycle of high-quality development within the solar sector.

If JinkoSolar successfully lists on the Frankfurt Stock Exchange, it will mark the first time a solar company has been publicly traded across China, the United States, and Europe. This advancement will further elevate the company’s ability to operate within international capital markets. Market analysts believe that introducing long-term international investors during this industry downturn will concentrate financial reserves, optimize debt levels and financing costs, and enhance the company’s sustainable development and risk mitigation capabilities. As a leader in global market share, JinkoSolar's long-term investment value is expected to be highlighted as well.

Post Comment